tax avoidance vs tax evasion south africa

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Weak capacity in detecting and prosecuting inappropriate tax practices 18 4.

South Africa Sets Up High Net Worth Tax Unit International Adviser

By contrast tax evasion is the general term for efforts by individuals firms trusts and other entities to evade the payment of taxes by illegal means.

. Basically tax avoidance is legal while tax evasion is not. Measures improving tax compliance 25 52. Is one of South Africas leading news and information websites.

While tax evasion was generally regarded as an illegal and dishonest means to escape tax tax avoidance was viewed as a legitimate and continue reading Continue reading. Financial decisions are wrapped up in. Discussions of tax avoidance often begin with an attempt to define and distinguish three broad concepts.

While there is typically agreement over the meaning of tax evasion the other two categories are more contentious2 22. Using unlawful methods to pay less or no tax. When considering evasion vs avoidance there are different tax reducing acts which will depend on the tax type at hand.

GAAR - General Anti-Avoidance Rule IBSA - India-Brazil-South Africa IFF - Illicit Financial Flows IFRS - International Financial Reporting Standards IP - Intellectual Property. Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment. Go to Upcoming Event List.

2 impermissible tax avoidance. Not only does it build on already existing materials and studies to. Recent waves of tax dodging scandals including those of tax.

Section 80A of the Income Tax Act deals with the issue of tax avoidance as follows. Businesses get into trouble with the IRS when they intentionally evade taxes. Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment.

Tax Deductions PAYE on your Pension or Annuity. Tax evasion on the other hand refers to efforts by people businesses trusts and other entities to avoid paying taxes in unlawful ways. Difference Between Tax Evasion and Tax Avoidance.

Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts. Avoidance vs evasion. Tax Avoidance is legal.

While tax evasion requires the use of illegal methods to avoid paying proper taxes tax avoidance uses legal means to. Measures improving the ability to enforce tax laws 26 521. Tax Avoidance vs Tax Evasion.

And 3 legitimate tax planning or tax mitigation. In tax avoidance you structure your affairs to pay the least possible amount of tax due. Diuga highlights the difference between evasion planning and avoidance.

When considering Value Added Taxes evasion on such would be deliberately understating sales or overstating expenses. What is tax evasion. It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in which to do so by use of mechanisms available under present laws and regulations.

An example of tax avoidance would be importing unbuilt items that are charged at a reduced import taxes rate and thereafter getting them assembled in South Africa. Tax avoidance is on the face of it lawful and some would even suggest that an. First tax avoidance or evasion occurs across the tax spectrum and is not peculiar to any tax type such as import taxes stamp duties VAT PAYE and income tax.

Tax Avoidance vs Tax Evasion. Modes of tax evasion and avoidance in developing countries 19 5. Examples of tax avoidance involve using tax deductions changing ones business structure through incorporation or establishing an offshore company in a tax haven.

While you get reduced taxes with tax avoidance tax evasion can result in. Acts need not fit under the taxing rules. It is said that the only difference between tax avoidance and tax evasion is the width of the prisons wall.

In tax evasion you hide or lie about your income and assets altogether. Tax Evasion vs. Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas Tax Avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of.

Legal Aspects of Tax Avoidance and Tax Evasion Two general points can be made about tax avoidance and evasion. This guide provides a comprehensive analysis of the issue of tax and wage evasion in South Africa. Businesses avoid taxes by taking all legitimate deductions and by sheltering income from taxes by setting up employee retirement plans and other means all legal and under the Internal Revenue Code or state tax codes.

Addressing weak enforcement at the. Avoidance would be making use of all the available provisions in the. However this first part also shows that the impacts for South Africa are not only in terms of taxes and public revenues losses.

Tax Avoidance vs Tax Evasion Infographic. Using unlawful methods to pay less or no tax. Strategies against tax evasion and tax avoidance 25 51.

Tax exemption for foreign employment income. Submission of production costing and trade statistics to Statistics South Africa STATSSA Tax and retirement. Tax filing season starts on 01 July.

Paying corporate tax in South Africa in 2020 is not for the faint of heart. In order to answer this question one needs to consider the difference between permissible tax avoidance arrangements and impermissible tax avoidance arrangements as well as the difference between tax avoidance and tax evasion. The difference between tax avoidance and tax evasion boils down to the element of concealing.

Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code. The recent EUs blacklist of 17 tax havens Paradise Papers and last years Panama Papers are among the starkest examples. Thus in the past it was generally accepted that there was a simple distinction between unlawful tax evasion and lawful tax avoidance.

In tax avoidance you structure your affairs to pay the least possible amount of tax due. Diuga highlights the difference between evasion planning and avoidance. Tax Evasion is illegal.

Secondly legislation that addresses avoidance or evasion must necessarily be imprecise. Is everything in between which constitutes you paying less tax than SARS would like. Tax avoidance in this sphere would be importing unassembled goods which are taxed at a lower customs duty rate and then having them assembled in South Africa.

Pdf Morality Associated With Fraud Corruption And Tax Evasion In South Africa

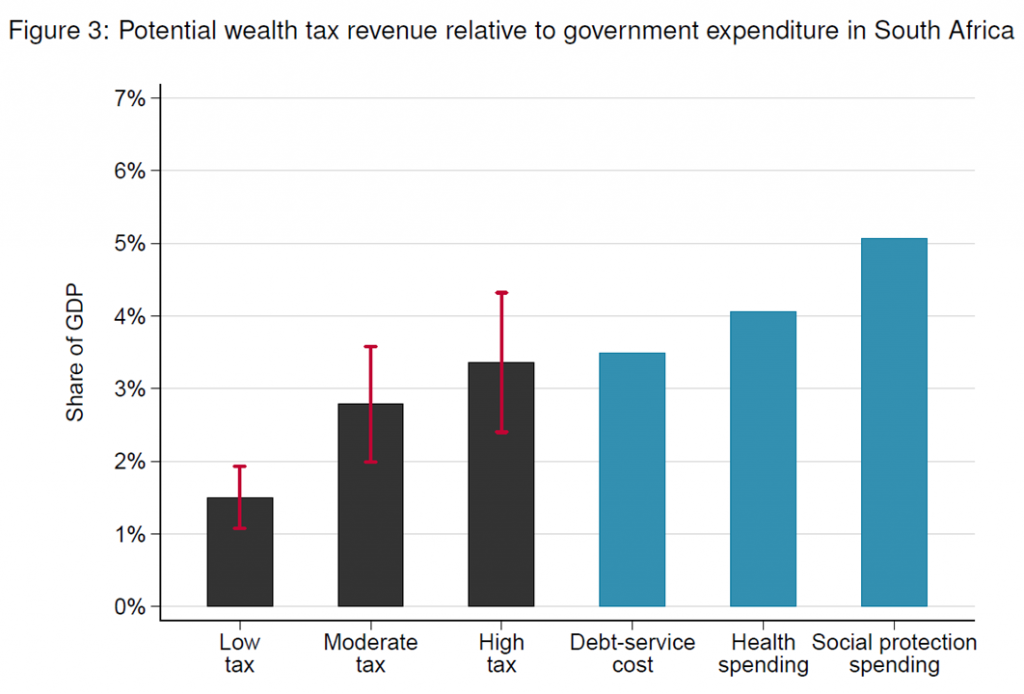

A Wealth Tax For South Africa Wid World Inequality Database

Perceptions Of Taxation A Comparative Study Of Different Individual Taxpayers In South Africa Semantic Scholar

Taxpayers Attitudes Towards Tax Amnesties And Compliance In South Africa An Exploratory Study South African Journal Of Accounting Research Vol 30 No 2

Pdf Towards Improving South Africa S Legislation On Tax Evasion A Comparison Of Legislation On Tax Evasion Of The Usa Uk Australia And South Africa

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Tax Evasion Berita Riset Dan Analisis The Conversation Laman 1

Perceptions Of Taxation A Comparative Study Of Different Individual Taxpayers In South Africa Semantic Scholar

How Much Time You Spend Paying Taxes In South Africa Sa Institute Of Taxation

Pdf The Fine Line Between Tax Compliance And Tax Resistance The Case Of South Africa

The State Of Tax And Wage Evasion In South Africa

Pdf Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Tackle Tax Evasion To Fuel Africa S Development

Perceptions Of Taxation A Comparative Study Of Different Individual Taxpayers In South Africa Semantic Scholar

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Pdf Revenue Approaches To Income Tax Evasion A Comparative Study Of Ireland And South Africa

Perceptions Of Taxation A Comparative Study Of Different Individual Taxpayers In South Africa Semantic Scholar